Reading time: 7 minutes

If you're like me and you find it challenging to picture how inflation could affect your life. Then you're in the right place. I used to find it hard to imagine something that intangible, despite inflation being the first lesson taught in Economics class.

Fast forward 15 years, and here we are: the threat of inflation in Europe is all over the front pages. America's super-hot inflation is at its highest peak since 1982. I hadn't been back in the US for 4 years. I was so shocked by the prices that it felt like a giant slap in my face.

How can something so invisible cause so much pain? I thought this would be the best time to challenge myself to address the elephant in the room.

This article is about looking at inflation differently - and not the one you learned in school. Inflation shouldn't be hard to grasp. I use three analogies: a Tesla, an iPhone and a Big Mac to make inflation more palpable. As always, I add a behavioural touch to go beyond statistics and numbers.

Inflation is like driving on a road

$1 yesterday is worth less today.

Inflation can be defined as an increase in price for a period of time.

Instead of going through a long macroeconomics speech, let’s use an analogy to explain the economy’s supervillain: inflation.

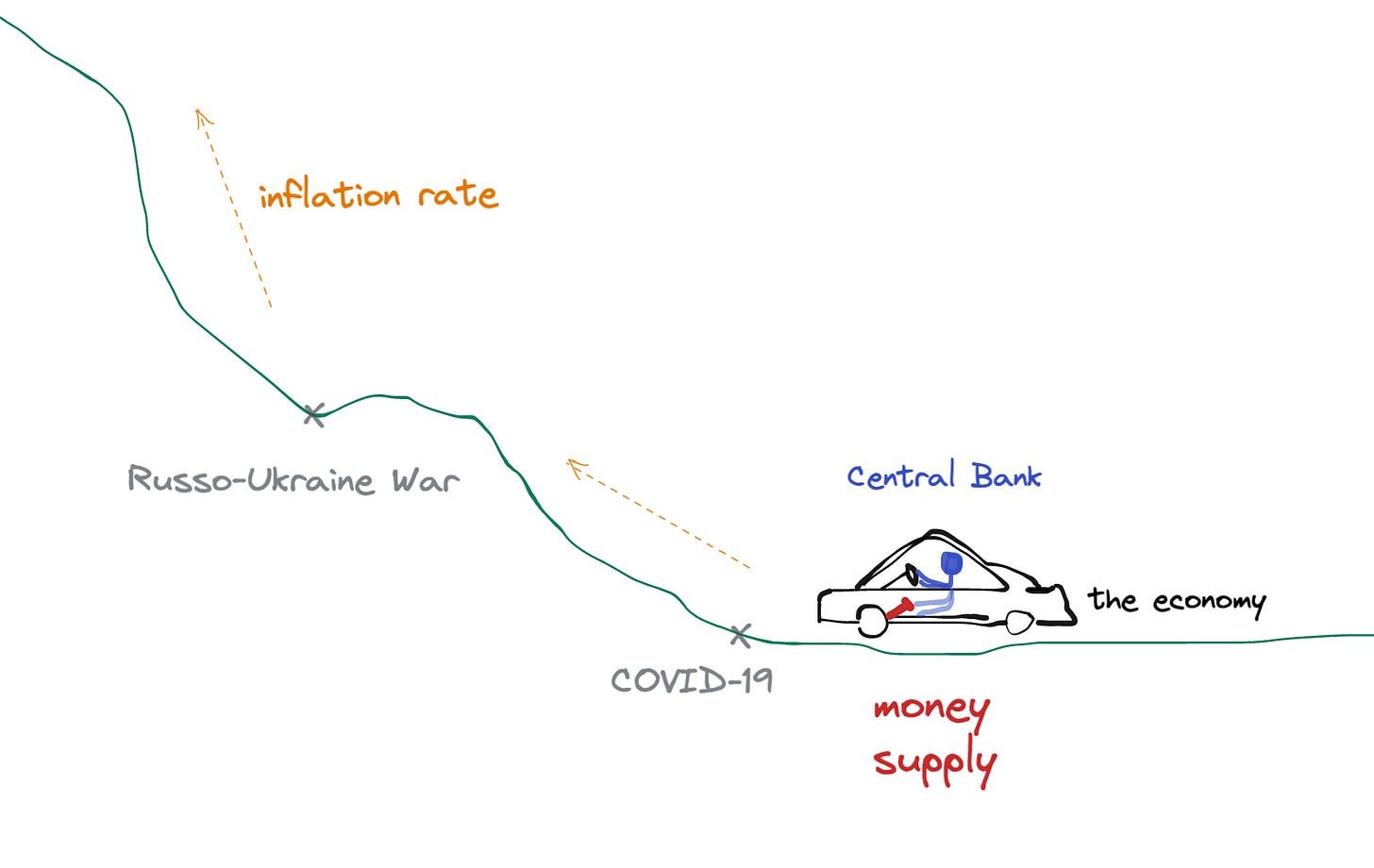

The driver (Central Bank) presses the accelerator pedal (money supply) to keep the car driving (the economy) at a constant speed (inflation) for a smooth and safe ride.

Like the pedal in the car, monetary policy is constantly adjusted to offset the economy's ups and downs to keep an inflation rate afloat.

By injecting the right amount of money, damages related to debts and purchasing powers are controlled, keeping the driving stable and steady.

However, as seen in the picture, the car was no longer on a boring linear highway. Instead, it’s moving towards a sinuous and hilly road. For the past two years, it has encountered major bumps: the Pandemic and the Russo-Ukraine War. As a result,

Demand has spiked. People were limited in terms of socialising and shopping during lockdowns. But once restrictions were lifted, they didn't hesitate to make up for their long desires.

Oil prices have increased. The Russo-Ukraine War has reinforced it, which directly impacts the cost of inputs. The good news is that Europeans are less dependent on oil than in the 1970s and less than our American peers. Stagflation (stagnation output + high inflation) is therefore very unlikely, according to experts.

To drive up the mountain, the driver must accelerate enough to keep it smooth. As the car doesn't react instantly, he sometimes leans the foot a bit too long or too short, which makes the experience jolt. Have you ever put one star for your Uber driving in fits and starts?

Similarly, for inflation, it's difficult to control the pedal. The delay between accelerating and the car's reaction can take up to months.

The highest existing “tax” illustrated with real life examples

Inflation has always been here. Yearly inflation of 2-3% is healthy for the economy. But today, we're reaching a double-digit inflation rate soon.

Why do we care? High inflation could lead to a drastic decline in purchasing power over time.

If you're like me, you can't easily picture the size of the percentage difference. Let me help you with three examples: a car, a phone and a burger.

Illustration 1: Tesla and its value overtime

With $30,000 today, you could buy a second hand Tesla.

At the pre-COVID inflation rate (2%), in 2057, with $30,000 of future money, you could buy half of a second hand Tesla.

At the current US inflation pace (9%), in 2030, you’ll pay $60,000 for a $30,000-dollar car you used to get for $15,000 ten years ago.A change in the inflation rate, even if it's 1% only, has a tremendous impact on future values.

With 2% inflation, $30,000 today is worth half in 35 years.

With 9% inflation, $30,000 today is worth half in 8 years.

Illustration 2: iPhone 13 and purchasing power in a year time

It's the New Year, and your old iPhone is almost dying. For once, you want to spoil yourself with an iPhone 13 with 512GB storage worth $1,129.

You set yourself a goal of saving $94 monthly so that you can gift it to yourself for Christmas.

As inflation is soaring, Apple could reassess their costs and benefits and update the price. It'd be now $1,197, i.e. $68 extra.

Unfortunately, the increase of 6% compromised your initial plan. You can no longer afford it. You’ve lost purchase power.

Illustration 3: Burgernomics effects on everyday life

McDonald's Big Mac Index is used as a thermometer for the current economy. Between 1986 and 2021, the US Big Mac price rose from $1.60 to $5.65, i.e. an average increase of 1% annually.

However, prices have increased by 8% this year. As a result, a Big Mac Meal's pre-tax price jumped to $8.39.

If it continues to rise at the same pace, in 10 years, your (un)Happy Meal will be at $18.11. Would you still be loving it?

This burger analogy is the most vicious one. You might not have to buy a Tesla or an iPhone, but you will surely eat every day. Whether you notice the fluctuations in prices or not, it nibbles away at your daily purchasing power in a sneaky way. You spend more to eat less both in quality and in quantity terms.

Fast food companies increase prices to maintain their margin. But, grocery prices rise even faster (beef prices skyrocketed with a 16% increase versus 8% for McDonald’s). These junk food chains' profits might not have been impacted much, but individuals' diets definitely have!

When the solutions become the problems

"Inflation is just like alcoholism… In both cases...the good effects come first, the bad effects only come later." Milton Friedman

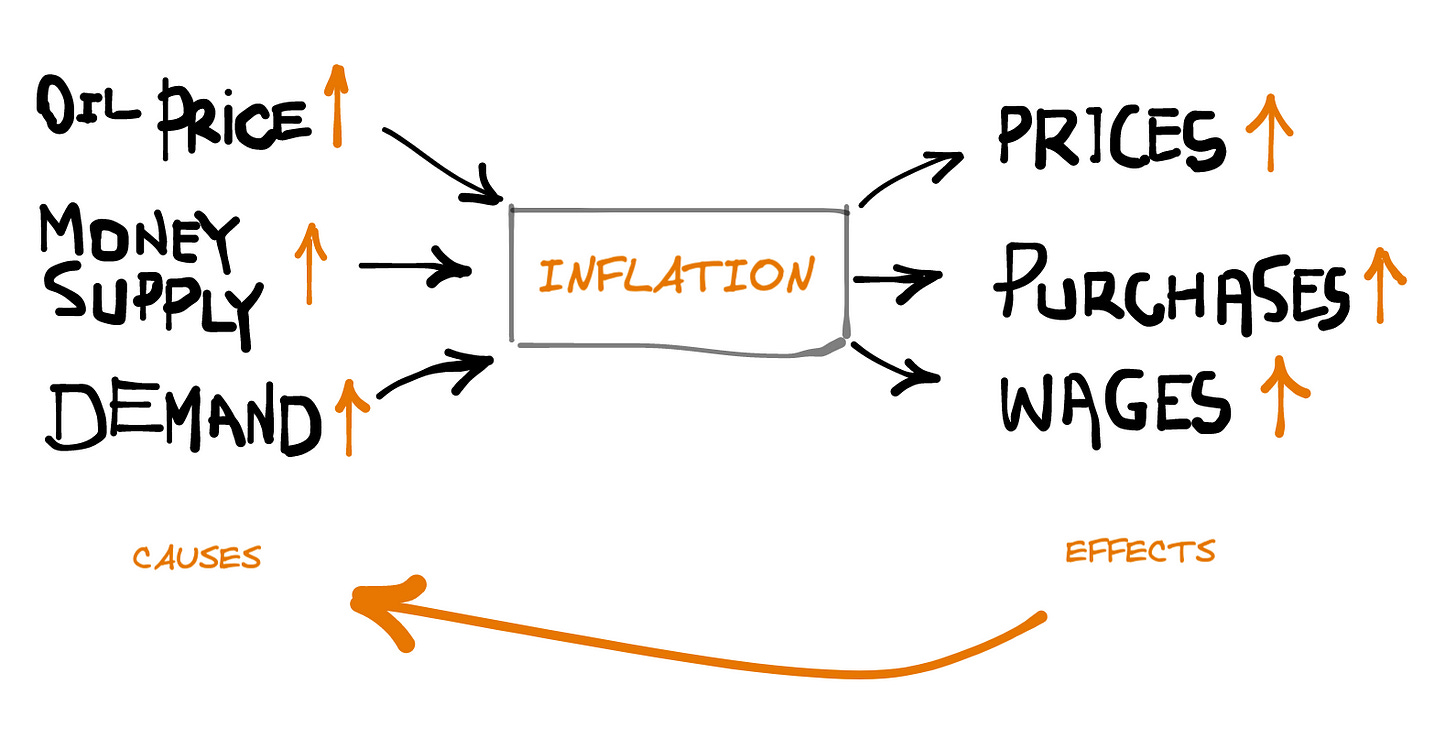

We've seen the three leading causes of high inflation at the political, economic and individual levels.

Now I want to talk about inflation's consequences on businesses and people's behaviour: the inflationary psychology. Indeed, inflation is not purely economic, but it's also psychological.

Inflation affects all sectors, from housing bills to vacations. As a result, salaries are being cut, capital gets nibbled every year and purchasing power is getting swiped violently.

Causes = Effects

Printing money helps decrease interest rates but then, in turn, the value of money diminishes too, which helps people to buy more.

It’s connected with the attitudes of anticipation towards inflation. While waiting for the inflation to stop soaring, all parties want to get the most out of it:

Businesses increase prices to hedge against higher costs and/or lower their offer to keep their profit margin

Employees request higher wages in response to the diminution of purchasing power

We enter into a wage-price spiral where they are feeding each other. Bingo! It's inflationary psychology.

A dog is chasing its tail.

So, does thinking about inflation lead to inflation?

Yes and no. The pessimistic ones tend to buy more in anticipation that prices will rise further. The optimistic ones tend to stop purchasing, hoping pricing goes down.

And the rest? They are doing nothing. This last category group can't process information in its correct sense. They conceive the piece of information irrationally, therefore can’t make financial decisions accordingly. In the psychology jargon, it’s called the "information processing bias".

Any of the behaviour patterns weighting more than another influence inflation.

From treading water to sustainable changes

“Staying optimistic is good, but be always prepared for the worst-case scenario.’”

To limit the pain of treading water, you need to stay within your depth. Regardless which category of person you’re (optimistic, pessimistic, neutral), there is only one combo to optimise your portfolio in difficult times: spend less + earn more + lose less.

1. Lower your standard of living

Reconsider your Big Mac. Eat out less, cook more. Don’t get FOMO. Your friends are most likely to do the same; if not, they will thank you later for influencing them. Your wallet will also thank you later for not overspending on sports activities and medical bills.

2. Get a higher pay

I usually encourage friends to ask for a pay rise, especially individuals who tend to undervalue their performance at work. But for once, perhaps ask for a reasonable raise rather than a rational one.

3. Invest smarter

The losing purchasing power effect doubles if the investment is not appropriately diversified. Not only do you buy less with more money, but your savings lose value on a daily basis (cf. iPhone example). Diversifying your portfolio is vital including assets with a higher interest rate than the inflation rate to avoid a negative interest rate.

Now that you have a fair understanding of the effect of inflation, what are your anti-inflation measures?